November Rallies and the Path to 2024

We are pleased to share with you our latest insights and updates as we embark upon the path to 2024.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

November Rallies:

November market performance posted a very strong recovery following a few soft months. The main driver still comes down to bond yields and the interest rate outlook. This in turn has been dependent on the inflation outlook.

As we can see in the chart below, the TSX provided no return to the end of October this year but surged 7.5% during November. The MSCI EAFE (non-North American developed markets) total return in Canadian dollars went from a 5% return at the end of October to 12.3% return. The S&P 500 accelerated from a 13.5% return to 21.3%.

This recovery corresponds to the peaking of long bond yields. Below we see US 10 Year bond yields drop from 4.9% at the end of October to 4.3% currently.

There are a couple main factors that can help explain this move. First, inflation has been coming down globally. The increase in inflation in the US and Canada due to energy prices during the summer has since drifted back down and is trending towards the targeted 2% rate.

In addition, economic data has been showing weakness that further supports lower inflation.

Below we can see global PMI (purchasing managers index) which is showing declines in the manufacturing sector (Manufacturing PMI below 50) and a significant deceleration in the services sector (from 55 to 50.2).

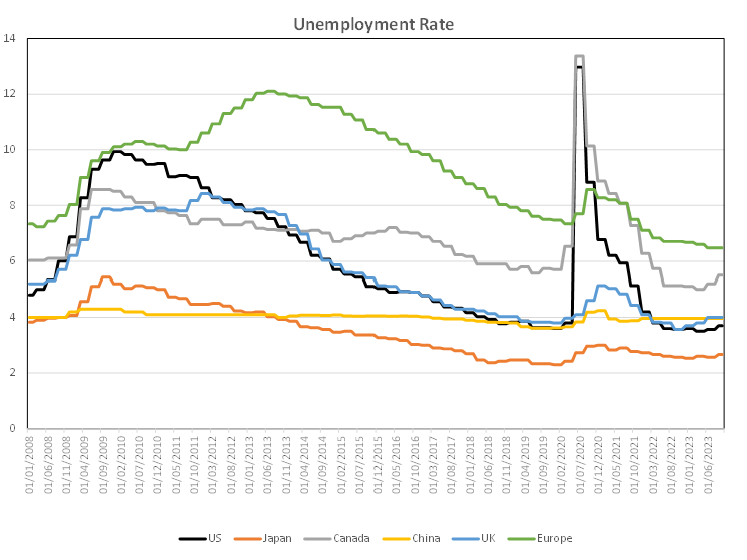

While the labour market remains healthy, incrementally the unemployment rate has been rising across most regions.

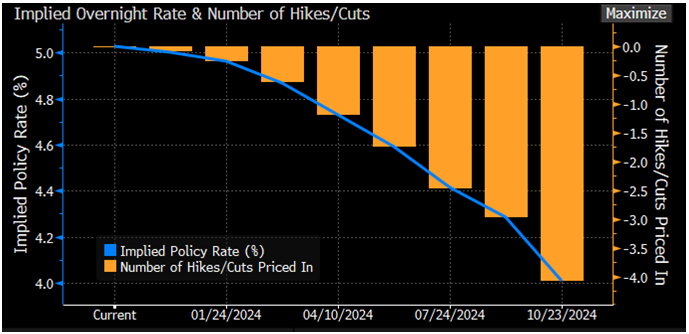

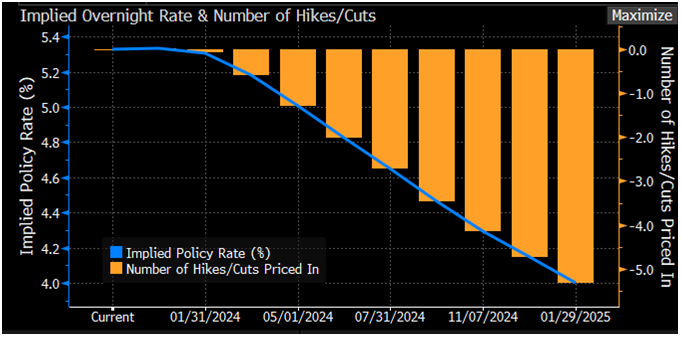

The result of this slowing macroeconomic environment is that the market is currently pricing in no more central bank rate hikes in the US or Canada with expected rate cuts potentially coming in the spring as the economy slows further going into 2024.

Canada:

U.S.

With this backdrop, we believe returns in the fixed income market will improve as bond yields decline further as we go into 2024 with a slow economy and inflation coming down further. We are also looking for opportunities within interest rate sensitive equities that have been performing very poorly due to higher interest rates but currently offer very strong dividend yields, attractive valuation and defensive businesses.

Regions in Focus

Canada: Economic data from Canada is starting to show the impact of higher rates. Inflation has decelerated to 3.1% from a peak of 8.1% in June 2022. Job creation has slowed with the unemployment rate rising to 5.8% in November from a low of 5% in March this year. GDP growth has also been weakening to -1.1% in the third quarter annualized. We expect further weakening going into 2024.

US: Inflation has decelerated in the US as well to 3.3% from a peak of 9.1% in June 2022. The unemployment rate has also risen in the US to 3.9% from a low of 3.5% in March. The US economy has proven to be much more resilient than others. Q3 GDP growth accelerated to 5.2% QoQ (quarter over quarter annualized) from 2.1% in Q2 and 2.2% in Q1. The US economy should be more resilient than Canada but higher interest rates will still have an impact on growth into 2024.

International: After an initial surge at the start of 2023, economic activity in China has been struggling. The property sector in particular has been weak. However, economic support measures from the government has been having some effect more recently. Retail sales growth of 7.6% in October has improved from 2.5% in July while industrial production grew 4.6% in October from a low of 1.3% in December 2022. However, Chinese NBS manufacturing PMI remains below growth territory at 49.4 while non-manufacturing PMI has decelerated to 50.2, barely above growth.

Stock Watch:

Switch: We recently switched out of our position in Franco Nevada (FNV-TSX) and into Agnico Eagle (AEM-TSX). Franco-Nevada has a royalty interest in First Quantum's (FM-TSX) Cobre-Panama mine which accounts for 18% of FNV's net asset value (NAV). The mine's operations have been severely disrupted and face other potential issues due to local protest over the mine. We sold quickly when share price weakness only reflected a partial impairment of the asset. We took the opportunity to sell our exposure in favour of gold producer Agnico Eagle. Agnico Eagle is a higher quality, lower risk gold producer primarily producing in Canada and Mexico. They are the world's third largest gold producer, have lower than average production costs versus peers and will generate synergies from recent acquisitions.

Buy: We recently initiated a position in semiconductor company Renesas Electronics Corp (6723-Tokyo Stock Exchange). The company has a 20% market share in the global microcontrollers market. End market focus is automotive and general-purpose products. We believe growth has reached an inflection point with revenue growth set to improve. Product mix will also help to expand margins. As these trends continue, attractive valuation could trigger a re-rating of shares.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

Strategies for Diversification and Risk Mitigation

At our firm, we prioritize maintaining a balanced and diversified portfolio to manage risks effectively. Our equities holdings remain steady, and we maintain a significant allocation to cash, which offers an attractive yield of over 5%. Furthermore, we are actively considering the option of reallocating some cash back into fixed income to capitalize on compelling yields and fortify against potential recessionary risks.

Long-Term Vision Amid Uncertainty

In conclusion, we adopt a vigilant approach amid the uncertainty surrounding global markets. Our focus remains steadfast on identifying potential opportunities while prudently mitigating risks. By maintaining a well-structured and diversified portfolio tailored to prevailing market conditions, we believe we can stay on course to achieve your long-term investment objectives.

Economic Empowerment through Knowledge

As a client of our investment management services, we are committed to empowering you with knowledge and insights to make informed financial decisions. Our dedicated team of financial advisors is always available to address any questions or concerns you may have. Your trust and confidence in us are paramount, and we are eager to collaborate with you on this exciting journey of financial growth and prosperity.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.