Navigating Volatility: Your Investment Portfolio's Resilience in Challenging Times

We are pleased to share with you the latest insights and updates on your investment portfolio. As of September's end, we have prepared commentary on the market's performance during the third quarter.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

Third Quarter Performance Highlights:

The third quarter market returns were volatile but ultimately ended up in decline. The total return in Canadian dollars was -1.0% for the S&P 500 Index, -1.8% for the MSCI EAFE Index (international markets), -2.2% for the TSX Index and -3.8% for the Canadian Bond Universe. We have been well positioned at JCIC for this environment. We have remained underweight fixed income markets with shorter duration and have more balanced exposure between corporate and government bonds. We have a large position in cash and equivalents as well which are generating good income without taking risk. Within equities, our Canadian and US equities were very marginally down during the quarter. Overall, our core balanced portfolio weathered the quarter well.

What happened during the quarter?

Central banks continued to raise interest rates, which we saw in Canada, the United States, in Europe and the UK.

We can see in the chart below, CPI in different countries trended down since peaking during various times in 2022, it still remains above the 2% target in most markets. This is why central banks continue to raise rates, especially as CPI actually started to rise again in the US and Canada, in large part due to higher energy prices.

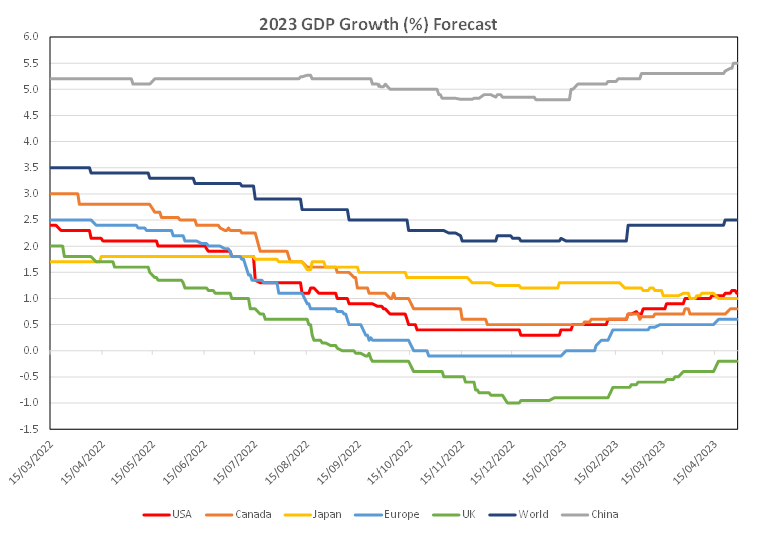

In addition, we have yet to see a recessionary environment despite the rate increases. Below the 2023 GDP forecasts have actually been revised up all year long.

And the unemployment rate, while starting to tick up, still reflects a relatively tight labour market.

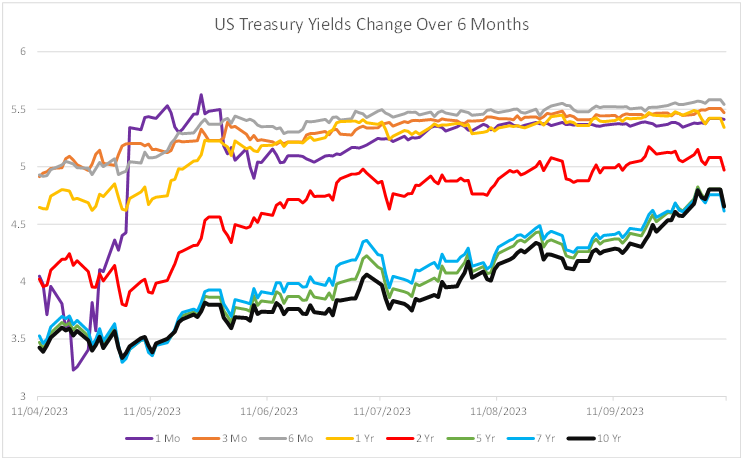

With this macro backdrop, we have seen an increase in longer duration bond yields. The US 10 Year treasury bond yield has risen from about 3.7% at the start of Q3 to 4.7% at the end of the quarter. This results in negative returns in the broader fixed income market and is a headwind for equity valuation.

So where do we go from here? We still believe we are close to or at a peak in central bank rates. We see a mild recession as the more likely outlook but has been delayed into 2024 rather than 2023. That is why you see in the chart below the 2024 global GDP forecasts have been cut all year long while the 2023 forecasts rose. As bond yields peak when the recession becomes more visible from the significant hikes in interest rates, this will improve the outlook for the fixed income market returns in which we anticipate deploying some of our large cash positions into the fixed income market. As it pertains to equities, a peak in interest rates is supportive but that must also be balanced out by the impact of recession risk. We will remain selective and will be prepared to take advantage of potential opportunities that open up.

Asset Allocation

During the quarter we lowered our fixed income duration further as short duration bonds offered higher yields and less downside if longer bond yields rise.

Stock Highlights

Cameco Corporation (CCO-TSX) Hold. We initiated a position in Cameco earlier in the year and has become one of our best stock performers. The company will benefit from the increased uranium price as they settle contracts with nuclear power producers. The supply and demand balance within the uranium market has improved significantly with limited new supply and prices yet to reach levels that encourage significant new development.

Novo Nordisk A/S (NOVOB-Copenhagen) Hold. We continue to like share in NovoNordisk. Historically the company benefits from the growth in diabetes care. However, growth is now being driven by weight loss applications. In addition, treatments are showing a benefit from cardiovascular disease. Most recently, another application in treating kidney failure is showing a lot of promise.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

Strategies for Diversification and Risk Mitigation

At our firm, we prioritize maintaining a balanced and diversified portfolio to manage risks effectively. Our equities holdings remain steady, and we maintain a significant allocation to cash, which offers an attractive yield of over 5%. Furthermore, we are actively considering the option of reallocating some cash back into fixed income to capitalize on compelling yields and fortify against potential recessionary risks.

Long-Term Vision Amid Uncertainty

In conclusion, we adopt a vigilant approach amid the uncertainty surrounding global markets. Our focus remains steadfast on identifying potential opportunities while prudently mitigating risks. By maintaining a well-structured and diversified portfolio tailored to prevailing market conditions, we believe we can stay on course to achieve your long-term investment objectives.

Economic Empowerment through Knowledge

As a client of our investment management services, we are committed to empowering you with knowledge and insights to make informed financial decisions. Our dedicated team of financial advisors is always available to address any questions or concerns you may have. Your trust and confidence in us are paramount, and we are eager to collaborate with you on this exciting journey of financial growth and prosperity.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.