Tax information for 2025

A selection of tax-related information we think you will find helpful.

As your portfolio managers, our goal is to make investing easier for you, and with investing comes tax obligations. With that in mind, this newsletter has a lot of information in it, but it isn’t intended as a ‘to-do list’ or to give you a lot to worry about.

Two key things to ask yourself:

Do you have unique circumstances in 2025? If so, please let us know. This might be an inheritance, selling your business, or any other event that dramatically changes your tax situation. If you’ve had some changes in your financial life but aren’t sure if there are tax implications, just ask us.

Do you have an accountant preparing your taxes? If so, please confirm your tax accountant’s information with us. Tax season gets busy and we want to make sure we have seamless communication with whomever is preparing your tax return.

For those two things, or anything else, you can reach out to your Relationship Manager, HERE.

Below is a selection of other tax-related information we think you might be interested in.

Registered Retirement Savings Plan (RRSP)

The most significant change to Canada’s RRSP rules is the increase of the contribution limit. The limit for 2025 is $32,490 (increased from $31,560 last year). Other changes include temporary repayment relief for the Home Buyers' Plan (HBP) and specific rules for contributing to a deceased spouse's RRSP.

The deadline for RRSP contributions to be counted against your 2025 income is March 2, 2026. (Feb 27th if your contribution is through a JCIC Fund.) But you don’t have to wait until the deadline. You can contribute to your RRSP at any point during the year.

The Tax-Free Savings Account contribution limit remains $7,000 annually. But because this amount is cumulative, you may have the ability to contribute much more.

If you have questions about the relative advantages of contributing to an RRSP, TFSA, or First Home Savings Account (FHSA), please reach out to your Relationship Manager.

Tax Rates

The federal government has reduced the marginal tax rate for the lowest tax bracket from 15% to 14.5%. It will be reduced to 14% in 2026. This means your first $57,375 of taxable income will be taxed at this lower rate. Income above that threshold will be taxed at a higher rate.

14.5% up to $57,375 of taxable income.20.5% between $57,375.01 and $114,750.26.0% between $114,750.01 and $177,882.29.0% between $177,882.01 up to $253,414.33.0% on any taxable income exceeding $253,414.

Note: This is the Federal Tax Rate. Provincial taxes are in addition to this and vary between the provinces. Also, Canada employs an Alternative Minimum Tax (AMT) system that may increase your taxes if your income places you in the fourth or fifth tax bracket.

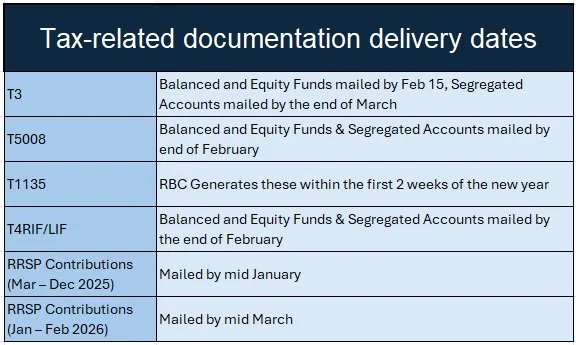

Documentation

Here is a list of documents you might need for your tax reporting, and the dates on which they’ll be available. Note: Not everyone will need all of these documents.

Two other tax rules you should be aware of if you own property.

Multigenerational Home Renovation Tax Credit

Are you building an in-law suite? This tax credit is in place for people undertaking renovations to create a self-contained secondary unit for a relative to live in. You can claim up to $50,000 in expenditures. The tax credit is 15% of the costs, up to a maximum of $7,500, for each eligible claim. Visit the CRA website to learn more

Home Vacancy Declaration

Do you own residential property in Toronto? Owners of properties in Toronto are required to declare the occupancy status of their property every year. You must declare your property’s 2025 status by April 30, 2026. Please visit the link to find out more and to make your declaration: Vacant Home Tax – City of Toronto

Tax filing can be confusing and stressful for many people. We are not tax accountants, but we are partners in your financial journey, and we are here to help in whatever capacity we can.

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.