A wrap up of 2025, and a look at the year ahead

2025 saw incredible growth in the markets, but most of that came in the first three quarters. Q4 saw modest growth and in some cases small retreats.

This report is presented by Kai Lam, JCIC’s Chief Investment Officer.

A modest conclusion to a banner year

In the fourth quarter, our JCIC Balanced Fund gained 1.8% (+13.4% for 2025), while the JCIC Equity Fund rose 1.1% (+16.0% for 2025). By strategy, the Canadian Equity portfolio returned 3.6% (21.3% 2025), the US Equity portfolio returned 0.3% (+11.3% 2025), the International Equity portfolio returned -2.6% (+28.6% 2025), and the Global Growth Equity portfolio returned -6.4% (+23.2% 2025). *All figures are in Canadian dollars.

In Canada, we saw double-digit returns during the quarter from Manulife Financial Corp (+16.0%), Royal Bank of Canada (+14.9%), CIBC (+12.8%), Dollarama (+11.8%), and Hydro One Ltd. (+10.8%). In the US, the strongest performers were Eli Lilly & Co. (+39.0%) and Alphabet Inc. (+27.04%). Our International equities were down during Q4, with Rheinmetall AG down 22.7% (but up 176.6% during 2025), Sony Group down 12.4% (+18.9% during 2025), and Linde PLC down 11.8% (-2.2% during 2025). Despite international equity underperformance during the fourth quarter, it remains our best-performing asset class for 2025 with a return of 28.6%.

Economic and Market Overview

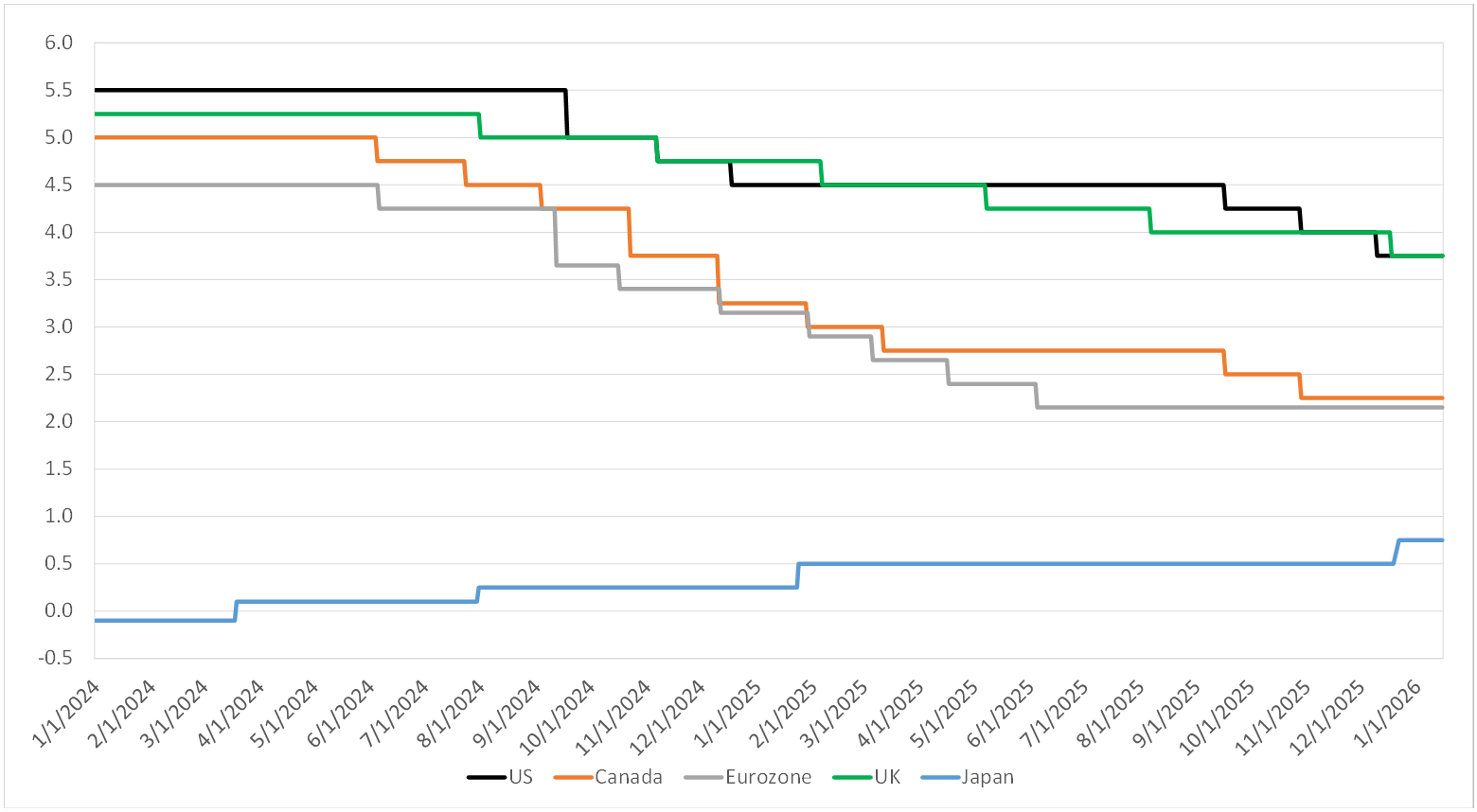

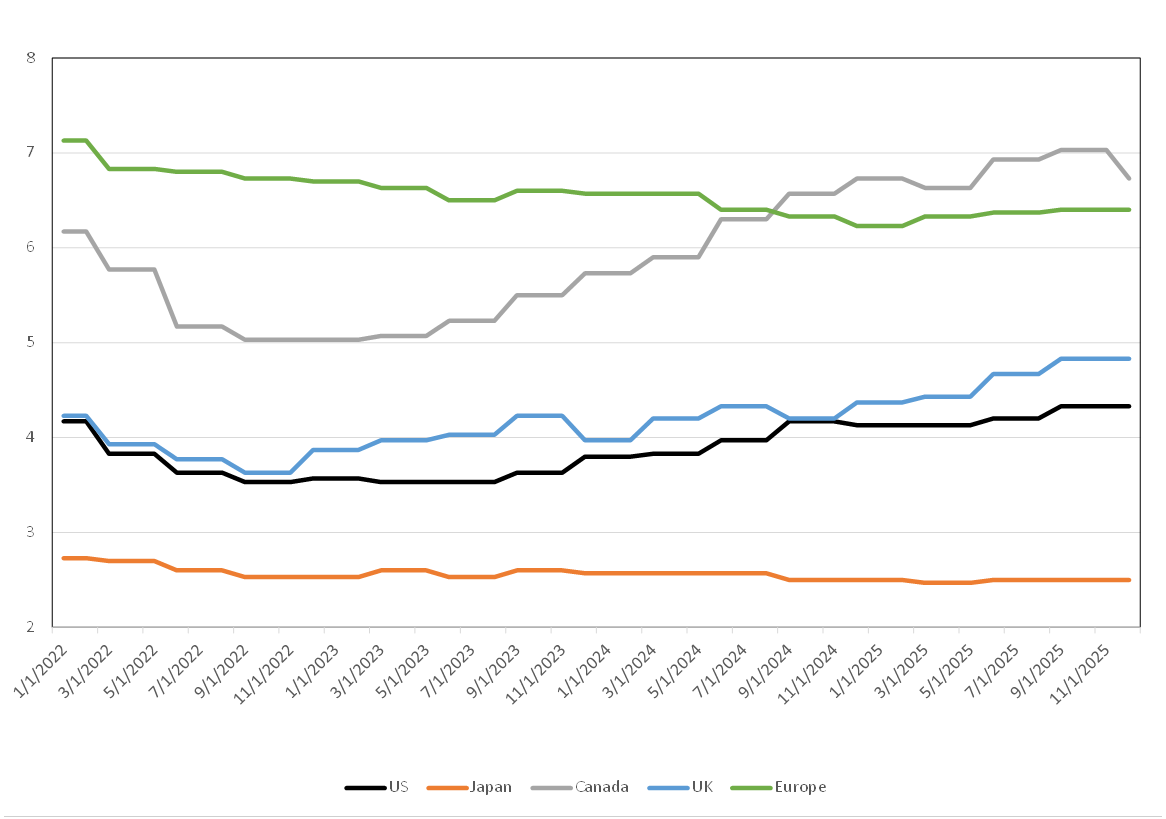

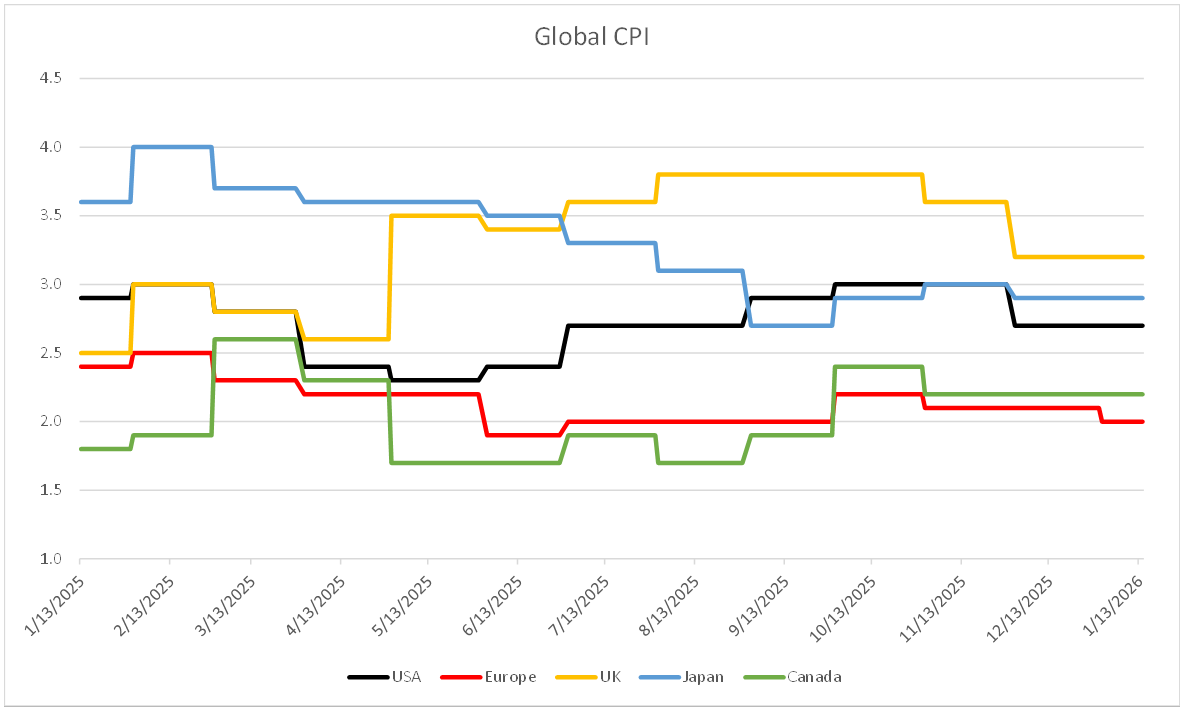

During the fourth quarter, we saw rate cuts in the US, Canada, and the UK, while the Eurozone kept rates steady and Japan increased rates to temper lingering inflationary pressures (Figure 1). This corresponds to trends in the unemployment rate, with worsening labour conditions (Figure 2), as unemployment in the US, Canada, and the UK increased, while unemployment in the Eurozone and Japan remained steady. Inflation also remained relatively contained, providing flexibility for rate cuts (Figure 3).

Figure 1. Central Bank Rates (%)

Source: Bloomberg

Figure 2. Global Unemployment Rate

Source: Bloomberg

Figure 3. Global CPI

Source: Bloomberg

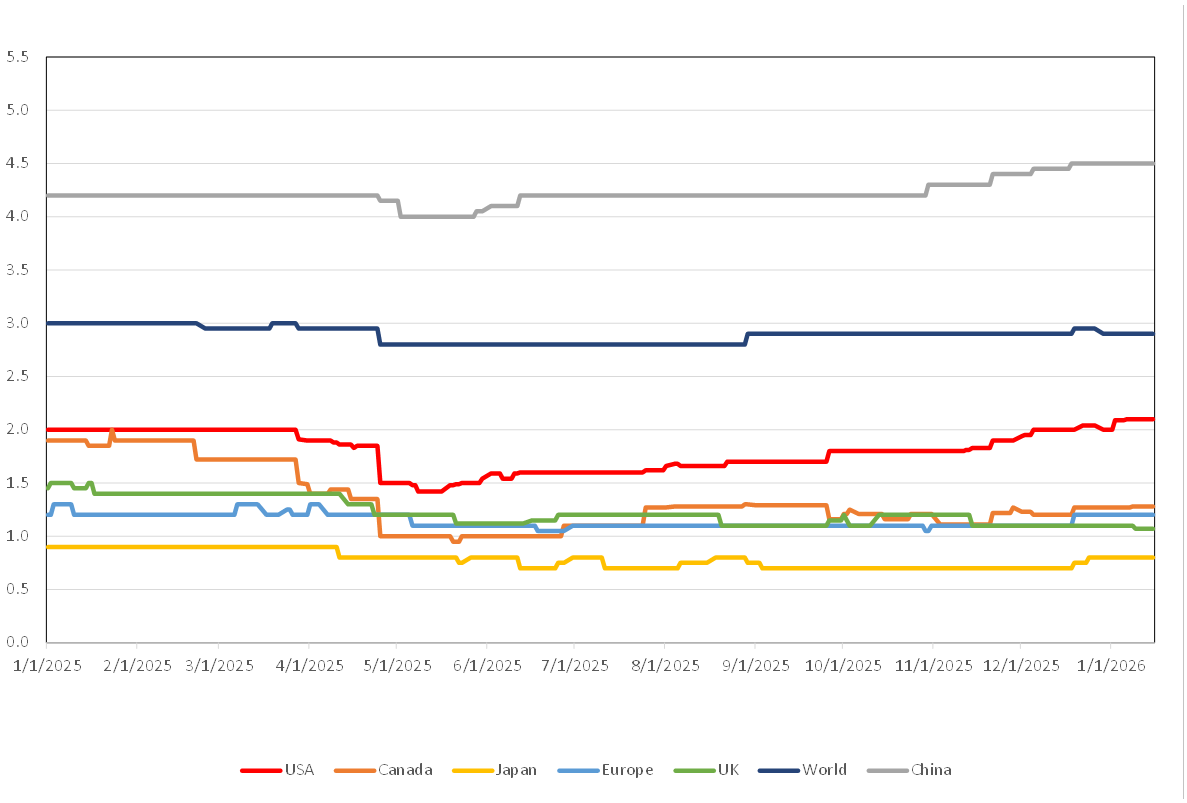

Going forward, the market is only looking for one or two more rate cuts from the US Fed in 2026 (which cut rates later than other central banks), no more rate cuts from Canada or the European Union, and one more from the Bank of England. As we look at 2026 Global GDP growth forecasts (Figure 4), growth expectations have risen over the past several months. That said, growth expectations remain relatively modest in Canada, the Eurozone, the UK, and Japan. US growth is higher, partly due to later rate cuts, a relatively stronger labour market, investments in AI development and infrastructure build-out and benefits from the One Big Beautiful Bill (OBBBA).

Figure 4. 2026 Global GDP Growth (%) Forecast

Source: Bloomberg

Performance by Region

Despite 2025 tariff uncertainty causing volatility, markets delivered strong double-digit returns across the US, Canada, and international markets.

In Canada, despite worsening unemployment, a slow housing market, and modest GDP growth, the equity market performed well thanks to outstanding gold stocks, Shopify, and Canadian banks. Gold benefited from high prices due to heightened geopolitical risk, central bank buying, and a move away from high-debt-country currencies. Canadian banks continued to deliver strong earnings by managing costs, improving efficiency, controlling credit losses and growing within wealth and capital markets.

For the first time in a while, the US equity market posted the weakest performance among global markets. Performance was highly concentrated in the Magnificent 7 names, as that group posted the highest earnings growth, while earnings growth outside the group was much more modest. However, this trend is changing, and recent performance has been broadening beyond this group as the growth outlook for non-Magnificent 7 names improves.

International equities also excelled in 2025, driven by lower valuations and improving prospects in sectors like European Defense, banks, and AI-related Asian and European semiconductor companies.

Outlook

So what do we expect for 2026?

Despite strong equity returns over the past three years, we remain constructive for 2026, as we expect earnings growth to drive markets higher.

In Canada, GDP growth will be relatively modest, supported by lower interest rates and potential clarity on tariffs. This will be partially offset by population growth normalization and a slow housing market. However, TSX earnings will be helped by strong growth in precious metals and materials, which have seen significant increases in underlying prices. We also believe Canadian banks will continue to perform well operationally as they execute on productivity improvements, drive Return On Equity (ROE) higher, and could benefit from clearer tariff impacts in the second half of the year. In addition, we see compelling opportunities in high-quality companies that have underperformed due to perceived negative impacts from AI competition.

We expect US economic growth to lead developed markets, driven by lower interest rates, the implementation of global trade deals, and reforms and tax cuts under the One Big Beautiful Bill Act (OBBBA). In addition, US company earnings are boosted by productivity improvements driven by the development and implementation of AI. This improved productivity is resulting in higher earnings with less labour required.

We also see opportunities in international equity markets, driven by beneficiaries of AI development and infrastructure building, increased European defense spending, increased spending and investment in Japan, and stronger relative valuation of international equity versus US peers.

We think tariffs and trade will be a main topic this year, but believe the peak fear occurred after “Liberation Day”. Since then, the US has reached many deals with other countries, settling on specific tariff rates applied to imports from each country. In general, tariff-related risks are lower now than a year ago. We also have to remember that two-thirds of the US economy is service-based, rather than goods-based. As a result, the impact of tariffs on inflation has so far been manageable. As for Canada, some sectors remain negatively impacted, including steel, aluminum, and lumber. The USMCA expires in 2026 and will need to be renegotiated. We expect significant headline risk from President Trump on this issue, but ultimately believe a deal will be reached and will have much more clarity sometime in the second half of the year.

We expect AI to remain very topical for the year. Some debate whether we are in an AI spending bubble. We are not in this camp. ChatGPT was only introduced three years ago. If we reflect on the time when the internet experienced significant growth, spending was much higher than current levels, and lasted for many years. We are still in the early stages of development in which companies that wish to establish leadership positions cannot relent on spending. This is not only true in the US with companies such as Alphabet and OpenAI, but also true for Chinese companies such as Alibaba. We see a significant opportunity in AI development and implementation to drive company earnings growth and productivity improvements.

As we have said in previous updates, the market is ultimately driven by earnings. At JCIC, we continue to invest with a long-term focus, guided by company fundamentals rather than short-term market movements or headlines. For 2026, we are seeing ample opportunities to invest in high quality companies with a positive outlook on growing earnings and delivering attractive cash flow.

If you have questions about any of this information, please don’t hesitate to reach out to us:

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.

* Performance percentages stated are gross of fees.