Signs Hint That a Broader U.S. Stock Market Rally May Be Taking Hold

A growing multitude of sectors, from small caps to even some energy names are beginning to exhibit encouraging indicators that the U.S. market’s current resilience is broadening.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

Stock bulls have fueled a rally on U.S. markets this year in spite of bouts of volatility, mixed economic data and a fraught outlook for interest rates.

The S&P 500 entered a new bull market last month after rising more than 20% from the humbling lows experienced last fall—which capped the longest bear market since 1948, according to Dow Jones data. For the year, that broad measure of U.S. stocks is up over 10%.

Our Balanced, Growth and Equity portfolios hold weightings of 28%, 36% and 44% in U.S. stocks, respectively, which means we closely monitor and scrutinize the trajectory of U.S. markets daily to determine how best to allocate our clients’ money.

Despite ongoing fretting over rates and recession risk, below the surface, there are encouraging signs this U.S. rally has legs.

Momentum Signs

To start, sentiment has been steadily rising, according to polling from the American Association of Individual Investors1, while data that tracks investments from retail as well as institutional investors indicate money that has been on the sidelines for much of the year is now moving back into equities2.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

But perhaps more encouraging is the rally’s “market breadth,” or the number of stocks participating in the rise. We’re seeing at last a pick up in shares beyond the big technology companies who’ve led the way year to date.

The Russell 2000, which is an index that tracks 2,000 of the smallest publicly traded companies in the United States, has rallied 5% through June. On a percentage basis, the “Russell” is still about a quarter below its all-time high, hit in 2021, but the recent momentum is good news for investors and the companies on the index.

Russell 2000, March 18-June 28, 2023

Source: JCIC Asset Management Inc.

More broadly, the Russell’s climb indicates investors may be becoming more constructive about the outlook of the U.S. economy; and it’s a signal to us that the health of the world’s largest economy is perhaps stronger than people realize.

Our view is partly informed by what we’re still seeing among U.S. households: cash to spend. It’s a point we’ve stressed in recent months, and bears repeating again—consumers still have excess savings in the bank and that extra cash helps explain the resilience we’ve seen in households’ ability to absorb inflation.

The chart below is U.S. commercial deposits, which spiked exactly in March of 2020, the first month of COVID restrictions. That savings glut above the long-term trend has peaked and is coming down but it hasn't fully reverted back to trend. There’s more to be spent.

US Commercial Bank Deposits

Source: Bloomberg.

That bulge may help explain recent moves in the discretionary consumer space, as well, with cruise lines and hotel operators starting to participate in the market’s rise.

Another indication of a market rally exhibiting hints of durability: the energy complex has perked up. Oil-and-gas has largely been terrible through 2023 after a stellar 2022. In recent weeks however, we’ve seen several large cap U.S. integrated producers see valuations move up.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

Yes, the so-called “mega caps,” i.e. Amazon, Apple, etc., remain the leaders, but the rally that’s begun with them is seemingly broadening, as evidenced by the Russell’s recent moves, as well as the support now being seen amongst other S&P500 stocks.

The chart below shows the performance for the S&P500 in black, the Russell 2000 index in green and the S&P500 equally-weighted index in red from March. The S&P500—driven by the largest stocks by market capitalization—has clearly led the pack, while the equally-weighted index has lagged. Yet similar to the Russell, it too has been moving higher, indicating a broader rise of companies across the entire index.

Signs Of a Broadening Rally

Source: Bloomberg.

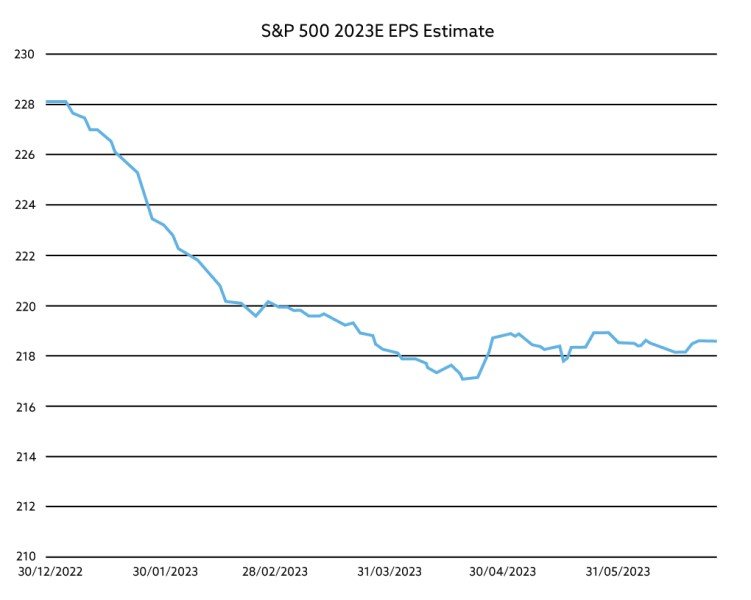

Another measure we have closely monitored are earnings expectations. The chart below shows S&P 500 EPS (earnings per share) expectations for 2023E. Last year, estimates were clearly too optimistic as high projected growth rates were not consistent with the slowing economic data. However, estimates have come down to more realistic levels and improved or stabilized for the past couple months. This is supportive of recent equity market performance.

Source: Bloomberg.

That’s not to say the second half of 2023 will see a sustained bull market—while we’re encouraged, much like central banks, our view, and subsequently are investment decisions are entirely “data dependent.” There are strategists we listen to who suggest Q3 and Q4 will be choppy, JP Morgan among them, who see the Federal Reserve continuing to keep rates elevated.

There are sure to be more bouts of volatility, while the interest rate environment will doubtless remain fraught; but as of this writing, the bulls appear to have more room to run.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.