Quarterly Performance Report (Q1 of 2024)

Encouraging returns, but is this a bubble?

In short, no. The underlying metrics are strong and balanced.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

2024 has started with a solid Q1 performance. Our flagship JCIC Balanced Fund was up 6.2%, while our JCIC Equity Fund returned 9.9%. We also offer more specialized segregated equity models in which our US Equity model increased 19.3% (vs. S&P 500 total return of 13.3%), the International Equity model returned 15.7% (vs. MSCI EAFE total return of 8.5%), and our Canadian Equity model returned 7.7% (vs. 6.6% for TSX total return) for the first quarter. Top performing stocks in the US included NVIDIA Corp (+87.4%), The Walt Disney Co. (+39.2%) and Valero Energy Corp (+35.9%). In Canada, WSP Global Inc (+21.7%), Canadian Natural Resources (+20.3%), and Waste Connections (+17.9%) led the group. Within international markets, Rheinmetall AG (+80.7%), Taiwan Semiconductor (+34.9%), Novo Nordisk A/S (+28.4%) and Stellantis NV (+24.7%) were all strong performers (all figures are in Canadian Dollar terms).

Are those gains sustainable, or a mirage?

With the market strength, clients have asked us if the market is overextended or in a bubble.

We would not call it a stock market bubble, but some areas of the equity market do seem extended in the short term.

Let's explore Figure 1 below. The market-weighted valuation of the S&P 500 on a 1-year forward Price/Earnings basis exceeds one standard deviation above the 10-year average. This suggests that the market might be pricier compared to historical averages. However, this is influenced by some of the largest companies within the index, as they have a larger market capitalization. Shifting our focus to Figure 2, which represents the equally-weighted S&P 500 index, the valuation seems to be more in line with the hisotical average. Thus, not all companies appear expensive to us based on this comparison. While most discussions focus on the S&P 500, it's important to note that valuations are relatively lower in other global markets. Figure 3 illustrates the TSX (Canada), while Figure 4 displays the MSCI EAFE (non-North American developed markets), both of which show valuations at more typical levels. We are still finding good value.

Figure 1.

Source: Bloomberg

Figure 2.

Source: Bloomberg

Figure 3.

Source: Bloomberg

Figure 4.

Source: Bloomberg

It's worth noting that despite the strength in the Fourth Quarter (Q4) last year, we have not seen much of a market pullback, which was a scenario we considered. This is particularly noteworthy given that bond yields have risen (Figure 5), while rate cut expectations have been tempered by resilient inflation as measured by the Consumer Price Index (CPI). Although inflation has been moderating closer to the 2% target, it remains somewhat sticky for many months (Figure 6). Overall, these factors can result in shifts in investor sentiment and asset allocation, so we continue to monitor the data.

Figure 5.

Source: Bloomberg

Figure 6.

Source: Bloomberg

As mentioned, in Q4 last year, stock markets improved strongly, and the performance was warranted after a weak 2022. The stock market discounted too much recession risk in 2023, which did not really happen. The economy was more resilient, and 2023 earnings estimates stabilized.

The fixed-income market (bonds) staged a robust recovery during Q4. We increased fixed income exposure in early Q4, but then bonds rallied so much that it was overdone, and we sold it back down before the end of 2023. The fixed-income market was discounting too many rate cuts for 2024 and was discounting these cuts to come too early in the spring. Given the strong rally in stocks and bonds at the end of 2023, it was a bit extended. We preferred high-yielding shorter-term cash and felt the equity market could take a breather because 2024 earnings growth expectations were still in the double digits and at risk. With an outlook for lower inflation and slow global GDP growth, low-teens EPS growth for the S&P 500 seemed too optimistic.

So, what has happened in Q1?

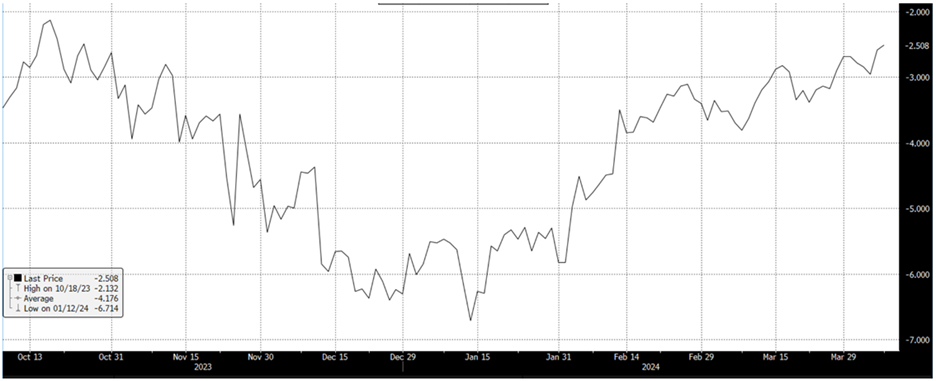

Economic data in the US has been strong and better than expected. We have gone from recession risk, to soft landing, to no landing at all. This pushed bond yields up, pushed out the market expectations on rate cuts later into the summer, and reduced the number of expected rate cuts. Figure 7 shows the futures market implied rate cuts by December 2024. At the start of 2024, 6 rate cuts were expected for 2024 but currently the number expected is only two to three cuts this year.

Figure 7.

Fed Funds Futures implied rate cuts by December 2024

Source: Bloomberg

How will inflation impact this performance moving forward?

Figure 8 shows inflation break-even levels in the futures market in the US. It is predicting where inflation will be in the future. You can see inflation expectations one year from now have gone up (green line), given the economy in the US has been so resilient; thus, yields rose, and the expected number of rate cuts was reduced. This should have been enough to bring some market softness. Still, the market focused on a smaller group of stocks that offered greater visibility and rising earnings estimates, such as the artificial intelligence-driven stock NVIDIA.

Figure 8.

Source: Bloomberg

Outside the US, the UK and Japan entered a technical recession with two quarters of negative GDP growth in the second half of 2023. Canada was not technically in a recession but was slow growing. And European growth was also stagnant. Given the sluggish growth environment everywhere except the US, we would have thought the markets would also be weaker. But look at Figure 9 below. It shows the 2024 GDP growth forecast for the past year. It declined through 2023 as the recession risk shifted from 2023 to 2024. Then, the US growth estimates improved with more robust economic data and a lower interest rate sensitivity than the rest of the world. However, recent economic data has suggested that growth estimates have been too low in other regions, including Canada. There have been green shoots of improvement in multiple global markets, including Canada, China, the UK, and Europe. This helps justify the recent broadening equity market performance despite being primarily driven by valuation expansion so far.

Figure 9.

Source: Bloomberg

Look at Figure 10 below. What it shows are various indices in local currency. Canadian fixed income total return is down 1.3% while US fixed income is down 0.8%. Emerging market equities are up 2.4%, the TSX (Canada) return is up 6.6%, the MSCI EAFE Index (non-North American developed markets) is up 5.8%, and the S&P 500 total return is up 10.6%. The EQUALLY Weighted S&P 500 return is up less than the S&P 500 at 7.9%. At first, the S&P 500 returns were driven by only a handful of mega-cap stocks, including NVIDIA Corp, Meta Platforms Inc, Amazon.com and Microsoft. However, performance has been broadening over the past several weeks.

Figure 10.

Market Indices Local Currency

Source: Bloomberg

We don't see the initial narrow stock performance as a bubble because they offered growth and rising earnings estimates. Some of them have become beneficiaries of the rapid secular growth opportunities in artificial intelligence. In the last quarter, I mentioned that we like secular growth stocks that offer growth in a low-growth environment. This positioning is working well. For example, our top three international positions were driven by the outlook for increased European defense spending (Rheinmetall AG), increased demand for semiconductor chips for AI applications (Taiwan Semiconductor Manufacturing Company) and early-stage growth in GLP-1 weight loss drugs (Novo Nordisk A/S).

What is the Bottom Line?

So, ultimately, we are not in a bubble, and the leadership in a focused group of stocks that are driving performance is justified at this point. What is encouraging is the broadening of stock market performance, as 2024 earnings estimates are reset at more reasonable levels and have been stabilizing. Going forward, we believe the market will depend more on earnings growth than on valuation multiple expansion. As such, we remain focused on owning high-quality companies that offer visibility, are driven by secular growth, or are economically resilient businesses generating strong free cash flow. With the rise in long bond yields, we are seeing more opportunities within the interest rate sensitive equities that we look to take advantage of.

If you have questions about any of this information, please don’t hesitate to reach out to us:

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.