Beyond The Surface: Decoding Market Signals and the Looming Recession Conundrum

Persistent inflation continues to be the driving force of monetary policy worldwide. The debate for a soft landing continues.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

Market Review

The market has exhibited remarkable strength over recent periods, with most companies surpassing earnings expectations. This robust performance indicates resilience amidst challenges and highlights the underlying potential of various sectors. However, we acknowledge that moments of volatility have also arisen due to specific events, leading to fluctuations in some companies' stock prices.

Global Economic Conditions

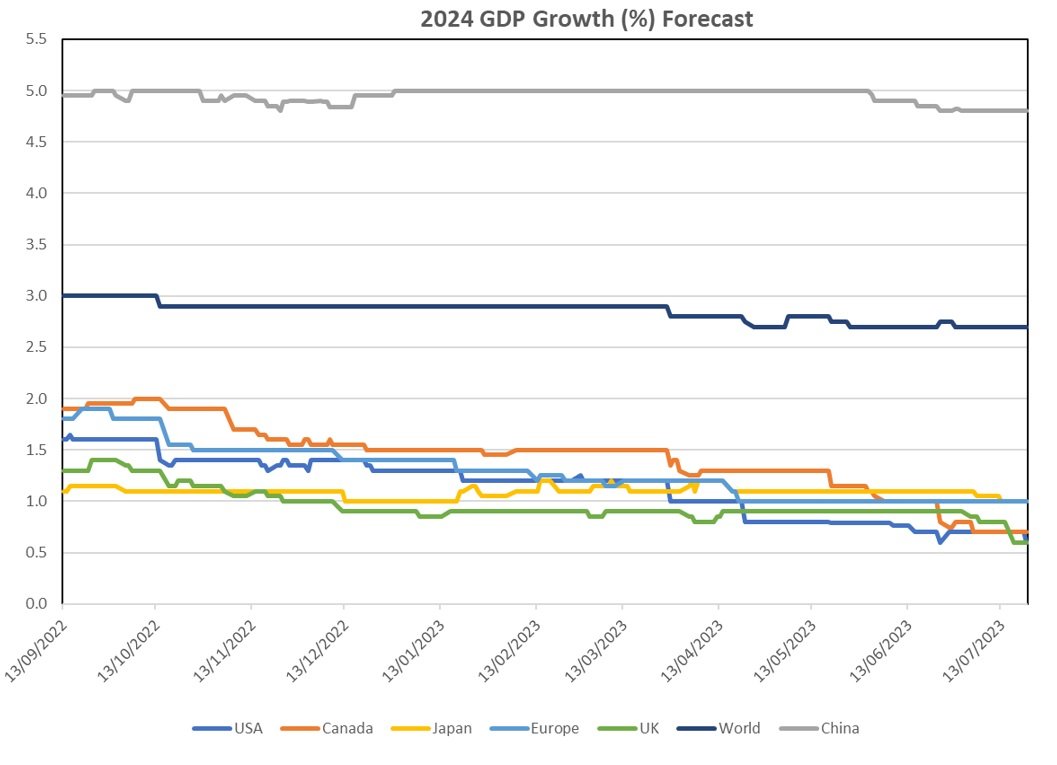

The global economic landscape remains a subject of interest and analysis. The European Central Bank (ECB) recently raised rates, and we expect multiple more hikes to come given persistent inflation. However, the ECB has recently taken a more dovish tone in their commentary. Meanwhile, the US economy demonstrated strength, with GDP outperforming expectations at 2.4%. These developments reinforce the belief that the US economy may be better positioned to withstand economic headwinds compared to other regions. GDP estimates for 2023 globally have been on the rise, but recessionary risks seem to be shifting to 2024 where estimates have been on the decline (see charts below).

Inflation & Monetary Policies

Inflation continues to be a central driver of monetary policies worldwide. Inflation has been on the decline globally but remains above targeted levels. The UK and ECB's decision to raise rates is a response to inflationary pressures, and further rate adjustments may be necessary to manage inflation levels effectively. Additionally, the Bank of Japan's potential change in their YCC (Yield Curve Control) policies could have ripple effects on global yields. We continuously assess these developments to adjust investment strategies accordingly.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

Soft Landing vs. Recession Outlook

The debate between a soft landing with low growth and a mild recession remains ongoing. As investment managers, we approach this topic with prudence, recognizing the possibility of both scenarios. Factors such as the potential exhaustion of COVID savings (demonstrated by above trend commercial bank deposit levels) and the impacts of interest rate hikes contribute to our cautious approach.

Source: Bloomberg.

Strategies for Diversification and Risk Mitigation

At our firm, we prioritize maintaining a balanced and diversified portfolio to manage risks effectively. Our equities holdings remain steady, and we maintain a significant allocation to cash, which offers an attractive yield of over 5%. Furthermore, we are actively considering the option of reallocating some cash back into fixed income to capitalize on compelling yields and fortify against potential recessionary risks.

Long-Term Vision Amid Uncertainty

In conclusion, we adopt a vigilant approach amid the uncertainty surrounding global markets. Our focus remains steadfast on identifying potential opportunities while prudently mitigating risks. By maintaining a well-structured and diversified portfolio tailored to prevailing market conditions, we believe we can stay on course to achieve your long-term investment objectives.

Economic Empowerment through Knowledge

As a client of our investment management services, we are committed to empowering you with knowledge and insights to make informed financial decisions. Our dedicated team of financial advisors is always available to address any questions or concerns you may have. Your trust and confidence in us are paramount, and we are eager to collaborate with you on this exciting journey of financial growth and prosperity.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.