JCIC 2023 Triumph, 2024 Outlook

We are pleased to share with you our latest insights and updates at the start of 2024.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

Q4 2023

We are happy to report that JCIC delivered strong returns to our clients in 2023. Our flagship JCIC Balanced Fund provided a 15.2% return, while our JCIC Equity Fund returned 19.6%. We also offer more specialized segregated equity models in which our US Equity model produced 36.9%, the International Equity model returned 19.4%, and our Canadian Equity model returned 11.7% for 2023. Top performing stocks in the US included Advanced Micro Devices (+121%), Amazon.com Inc. (+76%), Alphabet Inc. (+54%) and Microsoft Corporation (+54%). In Canada, Constellation Software Inc. (+59%), Cameco Corporation (+46%), and Alimentation Couche-Tard Inc. (+32%) led the group. Within international markets, Mercadolibre Inc. (+81%), Stellantis NV (+74%), Novo Nordisk A/S (+51%) and Schneider Electric SE (+43%) were all strong performers (all these figures are in Canadian Dollar terms).

What happened in 2023, and what are we expecting for 2024?

To recap, going into 2023, we had a more optimistic view for returns after 2022 delivered the combination of negative returns in equities and fixed income due to high inflation, rising interest rates and recession risk. We thought inflation peaked and would continue to trend downwards but remain above the 2% target. At first, we believed the rise in interest rates could lead to a mild recession in 2023 but expected a shallow recession as the labour market remained tight from a smaller labour force (the labour participation rate had not recovered from pre-COVID levels). With reasonable to attractive equity valuation, returns would improve as the focus turns to recovering from the recession. Fixed income exposure looked favourable as bond yields reached attractive levels.

Equity returns proved strong out of the gate in 2023 (Figure 1) as the market focussed on the peak of interest rates and attractive valuation. Our equities performed very strongly, and as a result, we reduced our exposure to be closer to benchmark weight. We kept proceeds in cash that was offering high yields. While equities performed well, one thing needed to be added. Earnings estimates were still declining and did not reflect realistic expectations. However, the economy and consumer spending held up better than expected, stabilizing the earnings outlook and providing further support for equities with increased visibility. This was more reflected within US and International equities. Canadian equities did not perform as well, offering no return to the end of October. This reflected the composition of the Canadian equity market, which saw weakness in energy and financials, which make up half of the index.

Figure 1.

Source: Bloomberg

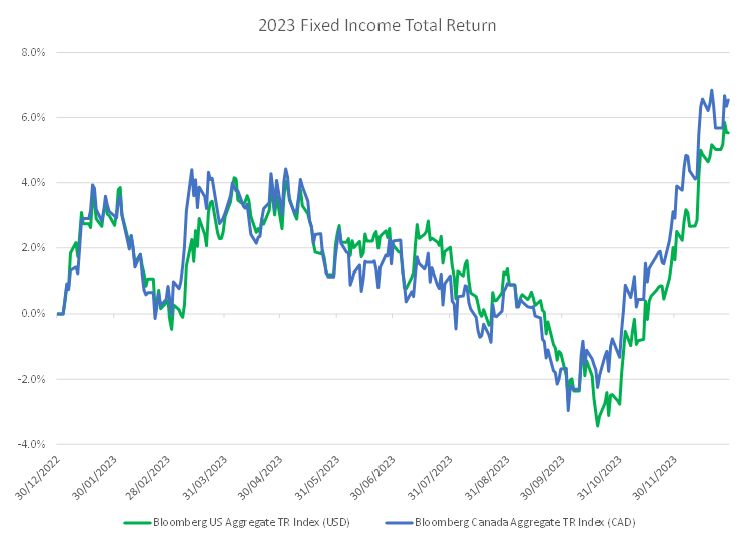

Fixed income struggled for most of the year (Figure 2). With resilience in the economy and a slow pace of inflation coming down, rate hike expectations rose, putting upward pressure on bond yields (Figure 3). The economy was resilient for multiple reasons. The labour market remained tight, with employers reluctant to lay off staff for fear they will have difficulty hiring them back. When people have a job and feel secure, they spend and support the economy. In addition, significant savings remained accumulated during COVID-19 that were still getting spent (Figure 4). As bond yields rose to attractive levels, we increased our fixed-income exposure using our high cash position.

Figure 2.

Source: Bloomberg

Figure 3.

Source: Bloomberg

Figure 4.

Source: Bloomberg

The fourth quarter of 2023 demonstrated strong returns in equities and fixed income. Inflation resumed its decline towards the 2% target (Figure 5), some economic data showed weakness, unemployment rose (Figure 6), and global manufacturing and services PMI (purchasing managers index) remained sluggish (Figure 7). With comments from the US Fed pointing to a pivot in rates in 2024, this led to rate cuts expected to come potentially in the spring, and the entire bond yield curve shifted down, providing reasonable fixed income returns for 2023 (Figure 2). The lower yields also supported equities, driving solid returns across our equity exposure (Figure 1).

Figure 5.

Source: Bloomberg

Figure 6.

Source: Bloomberg

Figure 7.

Source Bloomberg

What do we expect for 2024?

While we did not expect the economy to be as resilient as it has been after significant interest rate hikes, a mild recession in Canada is still likely but was pushed out longer than initially conceived. Canadian growth benefited from very high levels of immigration, a strong labour market with particular strength in job creation from federal government workers and there is a delay in the impact of rising interest rates from very low levels. However, Canadian household debt is very high at 181% of income and 103% of GDP, putting Canada at one of the highest levels in the world. The US could achieve a soft landing with lower sensitivity to interest rates and much better housing affordability. Household debt-to-income is lower at 97%, while household debt to GDP is only 75%. Labour productivity is also much higher in the US and has improved over Canada, which has demonstrated weakening productivity.

If we look internationally, Europe did not freeze over the winter and replaced natural gas supply from Russia through importing more LNG (liquified natural gas) from the US. While the economy has been more resilient than expected, 2024 should see a mild recession after significant interest rate hikes to combat high inflation takes hold. The ECB has indicated rate cuts should come in the summer but tempered market expectations on earlier timing and the number of cuts.

Elsewhere, China's post-COVID-19 recovery fizzed out quickly with a very weak property market, poor consumer confidence and risks from deflation. They still delivered GDP growth of 5.2% in 2023 but we expect this to moderate in 2024 and will require government support to keep growth above 4%.

With this global backdrop, we expect a mild recession in Canada and other markets including Europe. The US could achieve a soft landing but growth will be slow nonetheless and dictate a similar strategy. We expect inflation will further trend down towards the 2% target rate, paving the way for rate cuts within the first half of the year.

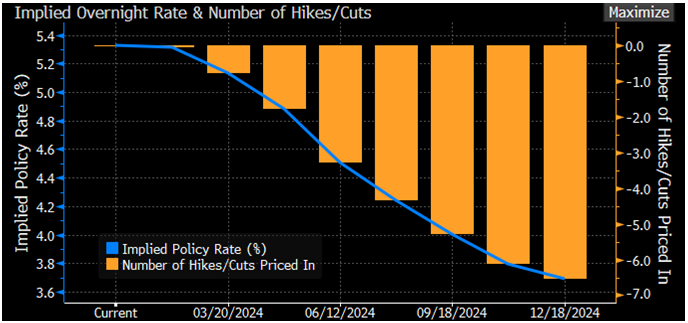

The bond market adjusted quickly in Q4/2023 and remains inverted (Figure 8). We still see some attractive returns in fixed income, but more so at the shorter end of the curve, which provides higher rates now and will benefit as rates come down. Longer-term bonds, such as the 10-year bond, look less attractive in the short term, but opportunities could surface later this year if the pace of rate cut expectations is too high. Currently, the market is pricing five interest rate cuts this year in Canada (Figure 9) and six in the US (Figure 10). If inflation remains sticky, these expectations may prove to be overly aggressive.

Figure 8.

Canada government Bond Yield Curve

Source: Bloomberg

Figure 9. CAD

Source Bloomberg

Figure 10. US

Source Bloomberg

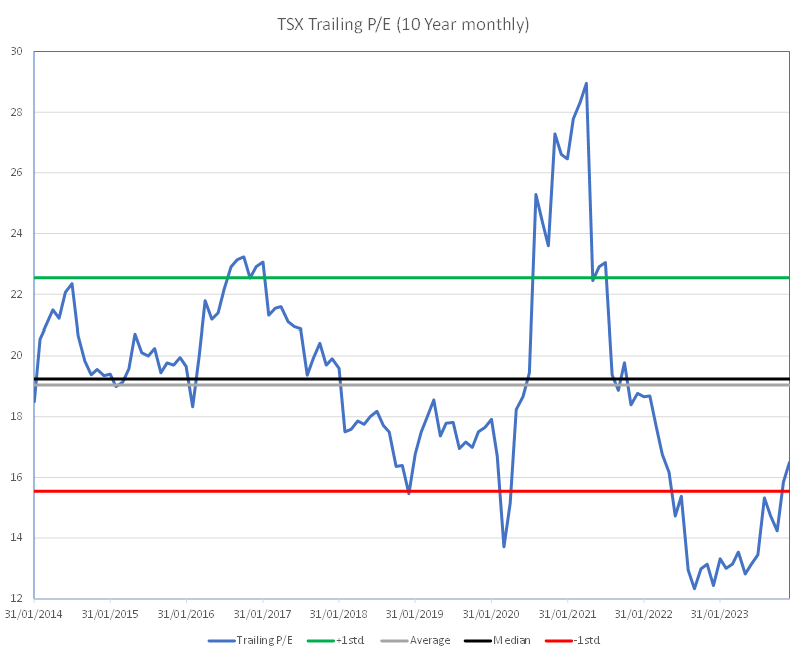

Within equities, valuation has expanded and appears relatively more expensive in the US (Figure 11). However, if we look at the equally weighted S&P 500, valuation seems more reasonable as it is not as skewed by the top 10 mega caps (Figure 12). As we look to Canadian (Figure 13) and International markets (Figure 14), valuation remains more reasonable. Equities will be more volatile initially as earnings expectations are too high. EPS growth is still forecast at 12% in 2024 for the US and 10% for Canada, which is not likely given the low GDP growth expectations and current levels of inflation. But once earnings estimates reset to realistic levels, we get weaker economic data and rate cuts; the market will focus on the recovery and support equities for 2024.

Figure 11.

Source Bloomberg

Figure 12.

Source Bloomberg

Figure 13.

Source Bloomberg

Figure 14.

Source Bloomberg

Within equities, we are currently favouring interest rate-sensitive companies that performed poorly in 2023. This is because higher interest rates put pressure on dividend yields and brought valuation to attractive levels. Areas like pipelines and telecom should serve better in a recession with higher earnings visibility and a strong dividend. In addition to interest rate-sensitive names, we also like secular growth stocks. As we do not expect a hard landing, we would also not expect a robust economic rebound. In a slower growth environment we like secular growth companies that can deliver growth in a slow growth environment.

Learn how JCIC can help you invest in a good life.

Contact us today for an easy, no commitment chat.

Strategies for Diversification and Risk Mitigation

At our firm, we prioritize maintaining a balanced and diversified portfolio to manage risks effectively. Our equities holdings remain steady, and we maintain a significant allocation to cash, which offers an attractive yield of over 5%. Furthermore, we are actively considering the option of reallocating some cash back into fixed income to capitalize on compelling yields and fortify against potential recessionary risks.

Long-Term Vision Amid Uncertainty

In conclusion, we adopt a vigilant approach amid the uncertainty surrounding global markets. Our focus remains steadfast on identifying potential opportunities while prudently mitigating risks. By maintaining a well-structured and diversified portfolio tailored to prevailing market conditions, we believe we can stay on course to achieve your long-term investment objectives.

Economic Empowerment through Knowledge

As a client of our investment management services, we are committed to empowering you with knowledge and insights to make informed financial decisions. Our dedicated team of financial advisors is always available to address any questions or concerns you may have. Your trust and confidence in us are paramount, and we are eager to collaborate with you on this exciting journey of financial growth and prosperity.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.