A Recession Is Likely. Here’s Why Investors Shouldn’t Panic

Rarely have markets discounted an early cycle recovery before actually descending into a recession. But we are not in a typical environment. Whether it’s a recession or soft landing, we are focused on quality and visibility.

Cameron Scrivens

Portfolio Manager and President

Kai Lam

Chief Investment Officer

The mistake most made last year was underestimating inflation. Nearly halfway through 2023—a year many condemned to recession before it even started—the mistake has been to underestimate that other “R” word, resilience.

Far from contracting, the global economy is showing strength few expected. While certainly not ablaze, conditions remain surprisingly hot: services PMIs are high, demand for things like air travel is strong, consumers are spending, and unemployment in Canada and the United States has skipped along multi-decade lows.

This resilience has occurred against a backdrop of cooling inflation, and has provided central banks a window to potentially “pause” aggressive rate hikes this spring (at least in North America). Alas, it’s a window that may be shrinking.

Inflation appears in need of another nudge lower, and markets now foresee the Federal Reserve and Bank of Canada likely hiking another 25 bps this summer, respectively.

What’s Priced in?

Swaps in 25bp of rate hike premium priced by July Fed policy meeting

Source: Bloomberg. Change in Fed’s interest-rate target implied by overnight index swaps and SOFR futures.

Whether or not central banks lift rates a bit higher is not our focus—we are approximately at the Fed’s terminal rate, in our view. The larger issue is, at what point will higher rates tip the economy into recession—and what will the depth of that contraction be?

Some Indicators

As the chart below shows, manufacturing Purchasing Managers’ Indexes (PMIs) globally remain at or below 50—a typical tell that recession is coming. Yet services PMIs continues to be strong, a trend across developed economies and clear sign that household consumption is making up for weakness elsewhere.

Global PMI

Source: JCIC Asset Management.

Services demand remains strong for a couple of reasons. To start, labour markets remain drum tight. Vacancies are down in Europe, Canada and the United States. Employed household spend earnings.

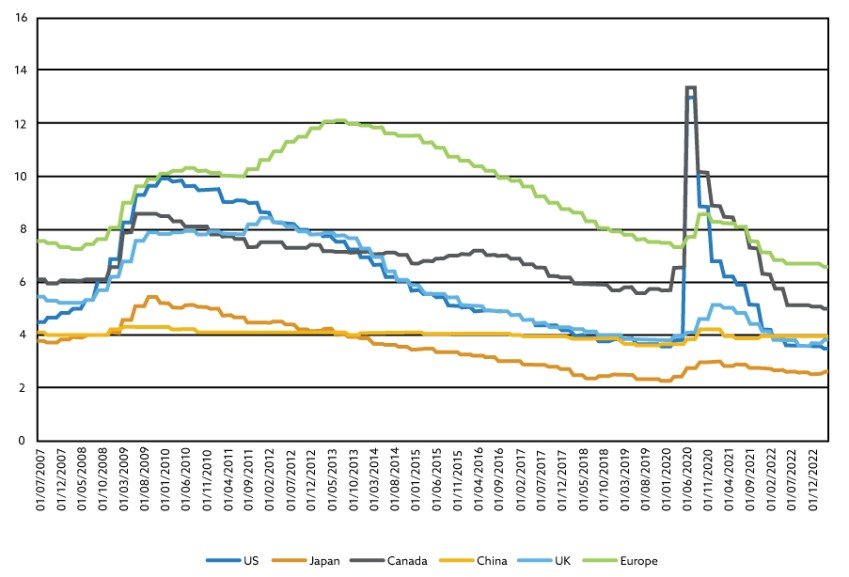

Unemployment Rate

Source: JCIC Asser Management.

Second, growth continues to be buttressed by excess pandemic savings. The chart below is U.S. commercial deposits, which spiked exactly in March of 2020, the first month of COVID restrictions. That savings glut above the long-term trend has peaked and is coming down but it hasn't fully reverted back to trend. There’s more to be spent (hence why airlines, for example, are delivering such buoyant summer guidance).

US Commercial Bank Deposits

Source: JCIC Asset Management.

Mild Recession

What goes up does come down, and our estimates suggest the savings glut will run out later this year, which also corresponds with when rate hikes will begin to be felt more strongly by households, as more mortgages and other debts are rolled into more onerous rates. Once the savings glut is exhausted, and interest rates are biting more deeply, unemployment should rise.

Yet with the labour market being so tight, and the participation rate still lower than before the pandemic, our view is that the jobless rate won’t spike much as it would in a typical recession. That’s a main rationale for why we're in the mild recession camp, and our portfolio exposures reflect that.

Our Approach

Being tactical and opportunistic is important in this environment. We’ve been buyers of cash-equivalent ETFs of late, vehicles that are yielding nearly 5% while giving us liquidity to move into favourable positions when opportunities present themselves.

In general, we take a concentrated position in equities, with less than 20 stocks in each market we invest in; Canada, the U.S. and International. The approach has led us to outperform most comparable benchmarks significantly year-to-date.

Further, a mild recession doesn't mean that markets can't work for investors. Slow or negative economic growth should mean inflations falls, which we view as very positive for markets, which should price in lower interest rates, supporting higher equity valuations.

In environments like this, we often talk to clients about a “barbell” approach to portfolio construction; of owning defensive companies with strong operating visibility going into recession, as well as holding positions in firms with secular growth tailwinds, such as some large-cap tech companies.

Even though our strategy is technically a barbell, the common theme in our holdings is that we have good visibility. If we are going into an environment where growth is slow—because we get a mild recession or even a soft landing –our portfolios are constructed to grow through it.

As your portfolio managers, our goal is to make investing easier for you. Whether you have questions, need assistance, or simply want to discuss the financial markets, please feel free to reach out to us. We're glad to help and engage in conversations about your investment journey or market trends.

NEWSLETTER

Disclosure:

Although we obtain information contained in our newsletter from sources we believe to be reliable, we cannot guarantee its accuracy. The opinions expressed in the newsletter are those of JCIC Asset Management, its editors and contributors, and may change without notice. Any views or opinions expressed in the newsletter may not reflect those of the firm as a whole. The information in our newsletter may become outdated and we have no obligation to update it. The information in our newsletter is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. It is provided for information purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. No recommendation or advice is being given as to whether any investment is suitable for a particular investor or a group of investors. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. We strongly advise you to discuss your investment options with your Relationship Manager prior to making any investments, including whether any investment is suitable for your specific needs.

The information provided in our newsletter is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. JCIC Asset Management reserves all rights to the content of this newsletter.